“It is a strange anomaly that men could be careful to insure their houses, their ships, their merchandise, and yet neglect to insure their lives – surely the most important of all to their families, and more subject to loss.”

– Benjamin Franklin

We insure all kinds of things in this day and age. Some of which because we are forced to, some of which because we want to. But mostly, responsible people buy all kinds of insurance products to protect themselves from the risks of everyday normal life.

Which is why, for responsible insurance professionals, consistently starting real life insurance and long term care conversations is a must. For as long as can be remembered, life insurance and long term care insurance are the least owned insurance products, yet are meant to protect the most probable losses people will suffer.

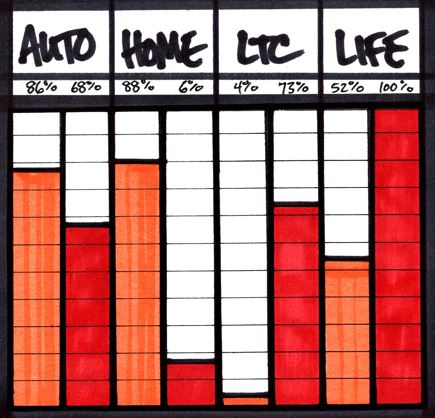

My apologies for the elementary chart. My generation is much better with crayons than we are with computer programs. But in the illustration below, you will find the following eye opening statistics in regards to policy ownership and likelihood of loss.

- In the US, recent studies have shown that 86% of Americans carry auto insurance, while 68% of people will at some point be involved in an auto accident or an auto insurance claim of some sort.

- Out of US homeowners, approximately 88% insure their homes. This is compared to the likelihood of experiencing a claim on your homeowners policy being at only 6%. While that is a really low number, homeowner claims are often huge financial losses.

Here is where things get wild.

- Only 4% of Americans carry Long Term Care Insurance coverage. Today, you have a 73% chance of ending up in a nursing home in your lifetime.

- The numbers for Life Insurance are better, but the spread is still as troubling. 52% of Americans carry life insurance. That doesn’t mean they carry enough life insurance, only that 52% have some coverage. This is compared to the not so shocking mortality rate we all have of 100%.

Most people put life insurance and long term care insurance off because they believe that they are healthy and have plenty of time before they need to prepare for those risks. But the truth is, procrastinating on either generally results in someday becoming sick and ineligible, suffering a loss before taking action, or not being able to afford it because they waited until they were much older.