Why Single Premium Whole Life Insurance is Still Better Than a CD, even at Today’s Higher Interest Rates.

After decades of historically low interest rates, the Covid-19 pandemic and resulting supply chain issues have pushed inflation to 40 year highs. In an effort to curb the severity of this inflation, the Federal Reserve has raised interest rates several times.

As a result, the current Federal Funds rate is toggling between 5.25% and 5.5%.

While this makes loans more expensive for borrowers, it should yield better returns for investors in such products like CD’s.

But does this increase in rates make certificates of deposits a better option than a single premium whole life policy?

I would argue that in many, if not most cases, a Single Premium Whole Life policy remains a better option.

Example:

A healthy 65 year old female has $100,000 in funds that she doesn’t need to live on, nor does she intend to spend it. This is money that she has set aside that she would like to leave to her grandchildren when she passes away. She likes CD’s because they are safe, and while they don’t produce huge returns – that safety is what is attractive to her.

Today, she likes CD’s even more because the interest rates have gone up. But I would tell her that if she intended to leave that money to her grandkids, a single premium whole life policy would be a much better option.

Why?

While interest rates are up today, the Fed’s goal is to get them trending back downward. Which means the higher interest rates are most likely temporary. The longest CD that I found in a google search was only a 14 month CD. That CD currently is paying 5.05%, but what happens at the end of those 14 months? You would have to find another CD, which could be at a lower rate. So over the long term, we cannot predict, or rely on a consistent rate of return.

Another thing we cannot predict is how long we are going to live. If she dies tomorrow, that $100,000 is most likely worth $100,000. While that’s still a wonderful gift, why not leverage it into a larger gift?

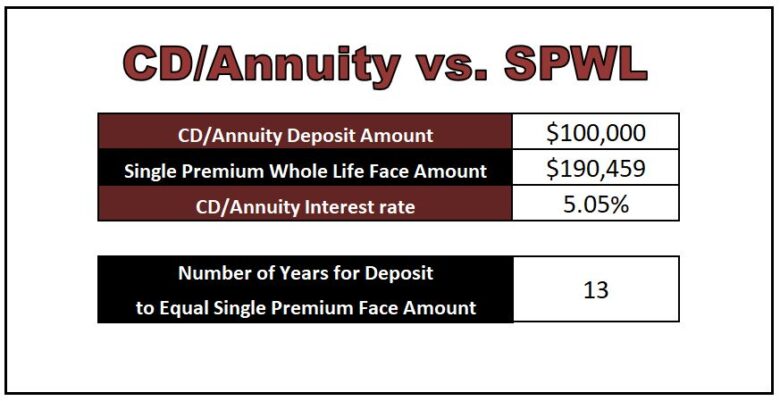

If she was reasonably healthy, this 65 year old female could probably expect to get a tax free death benefit of $190,459 on a single premium whole life policy with a planned one time deposit of $100,000. If and when that policy were to be issued, that would be an overnight increase of the gift to her grandkids of $90,459. 100% tax free as well.

Could she get to the same level using CD’s? Possibly. It would take 13 years at a level interest rate of 5.05% for that $100,000 CD to grow to $190,459. While it could happen, it’s highly unlikely that anyone is going to be able to consistently find CD’s paying that kind of interest rates for that long. In addition, there is no guarantee that a 65 year old will live another 13 years. The blended US life expectancy is 79 years old, and that timeframe would put her at 78.

That’s the problem – we just don’t know. But the life insurance option gives us the same result right away.

For those who want to guarantee and maximize a lasting gift to your loved ones, or the non-profits that you are so passionate about – my opinion is that whole life insurance, whether single premium or not, is vastly superior to sticking your money into Certificates of Deposit.