CD’s (Certificates of Deposit) have long been a favored financial tool for many in their retirement years. Although you won’t achieve spectacular growth with a CD, they do provide a guaranteed return with little to no exposure to risk. For people who have retired and have little time for market recovery in the event of losses – the CD has always been a constant option.

The CD lost some of it’s luster in the last 15 – 20 years due to interest rates being at nearly zero, however with the latest rate hikes some rate offers are looking more like rates of the past.

But does this mean that the CD is the best option for everyone? Of course not. Many people who place their cash in CD’s often consider that cash as “never money“. Perhaps I’ve invented a new term, but what “never money” means to me is:

- It’s liquid cash on hand.

- This cash is not needed to live on, nor are there any plans to spend it.

- There is a desire to conservatively grow the money.

- The end goal is to leave to kids, grand kids, charity, or both.

So is “never money” best in a CD? I would argue that in most cases, if the person is healthy enough, this money would be better suited going towards a Single Premium Whole Life policy.

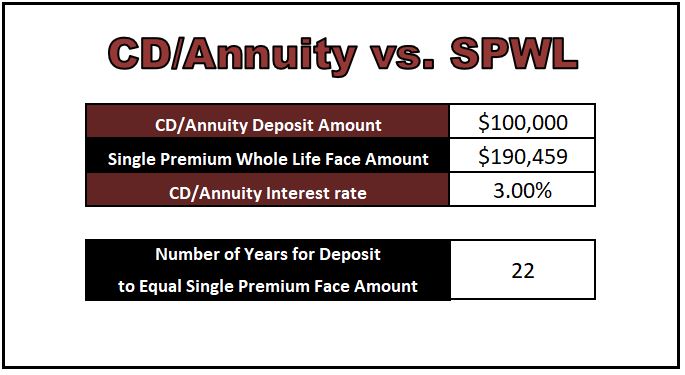

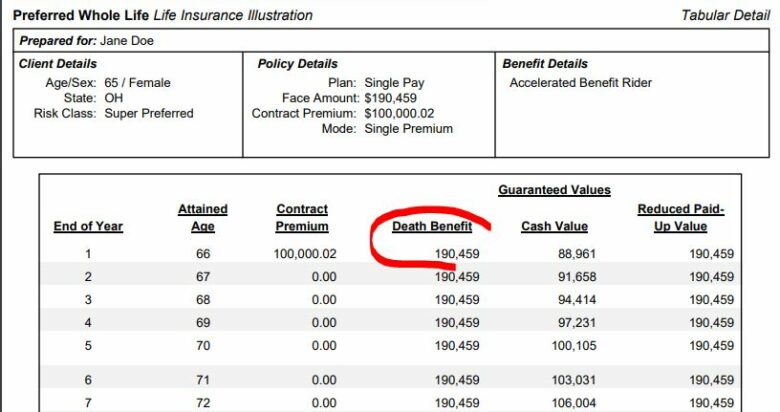

So let’s compare $100,000 in cash going to a Single Premium Whole Life policy versus a CD. We’ll have to make the unrealistic assumption that our CD rate is good for eternity (which it wouldn’t be). We will pretend this is for Jane Doe, a 65 year old, healthy female.

Single Premium Whole Life

Jane is healthy and applies for a single premium whole life policy. Jane and her agent applied for coverage based on a one time single premium of $100,000. Jane is approved and in this example her death benefit is immediately $190,459. Now regardless of whether Jane passes away soon after at age 65, or many years down the road – Jane’s designated beneficiaries will collect the $190,459 death benefit tax free.

Certificate of Deposit

Let’s say Jane instead finds a CD that never expires and pays an interest rate of 3.0%. Jane deposits the entire $100,000 into the CD. With compounding interest, Jane’s balance would not catch up to the day 1 death benefit amount of $190,459 for 22 years, or age 87. If Jane continues to live past 87, it still works out. But as we all know, how long we live isn’t guaranteed – but we can guarantee the amount we leave our heirs in the form of a death benefit.