Have money sitting in CD’s that you want to keep safe? Is your goal for that money to be passed on to your heirs or your church, charity, or all of the above? Let’s go ahead and compare today’s average CD return to a single premium whole life policy.

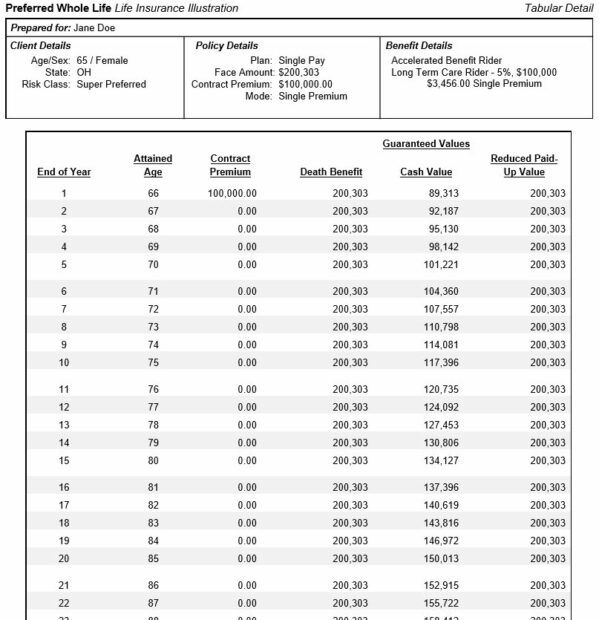

We are going to take a healthy 65 year old female with $100,000 of liquidity that she wants to make sure benefits her loved ones or charitable aspirations.

A single premium deposit in a whole life policy would get her a $203,303 death benefit that would be completely free of taxes and probate……DAY ONE.

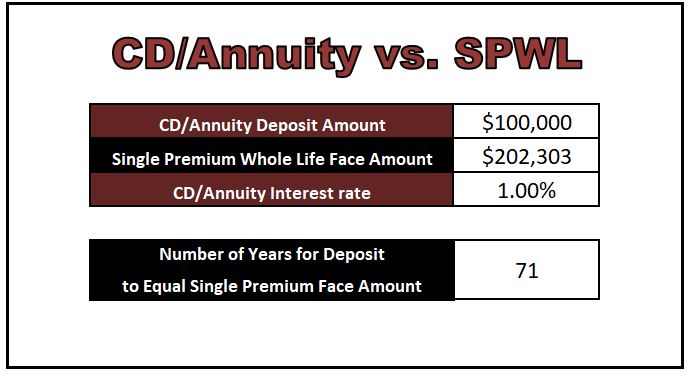

Now, lets look at how long it would take for a CD paying 1% to reach a balance of $203,303. The answer? 71 years from today.

Ok, well my Annuity contract pays higher than that. How about 2%? THIRTY SIX YEARS

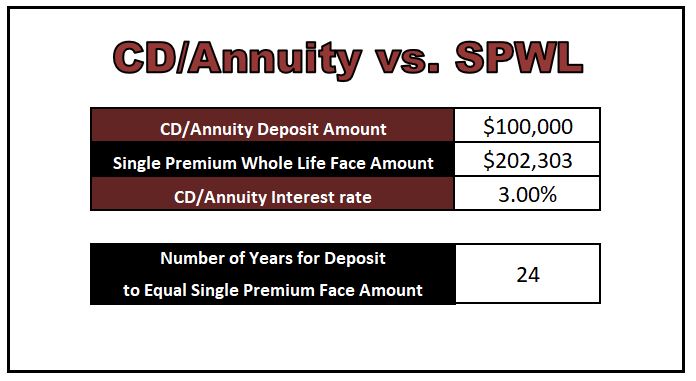

Ok……3%…..still would take TWENTY FOUR YEARS.

If you have money you have set aside in a CD, Annuity, IRA, Cash, that you would like to maximize leaving behind, contact Joseph D. Beck, CIC, CPRM, VP at Beck Insurance Agency today.

419-446-2777 / joe@beckinsurance.com / or click HERE.