Comparing CD returns to Single Premium Whole Life Insurance

The CD lost some of it’s luster in the last 15 – 20 years due to interest rates being at nearly zero. However, with the latest rate hikes some rate offers are looking more like rates of the past.

But, does this mean that the CD is the best option for everyone?

Of course not. Many people who place their cash in CD’s often consider that cash as “never money“. What “never money” means to me is:

- Liquid cash on hand.

- This cash is not needed to live on, nor are there any plans to spend it.

- There is a desire to conservatively grow the money.

- The end goal is to leave to kids, grand kids, charity, or both.

So, is “never money” best in a CD?

I would argue that in most cases, if the person is healthy enough, this money would be better suited going towards a Single Premium Whole Life policy.

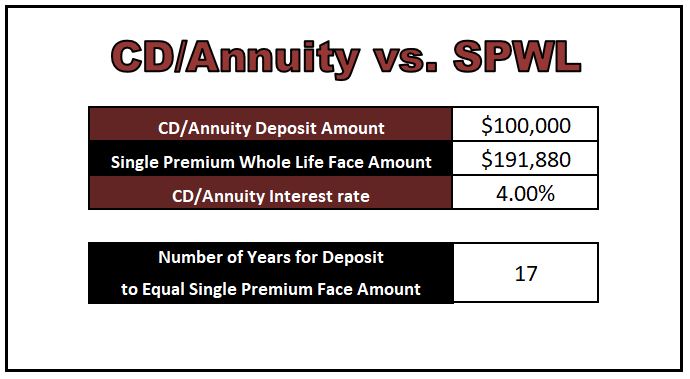

Let’s compare $100,000 in cash going to a Single Premium Whole Life policy versus a CD. We’ll have to make the unrealistic assumption that our CD rate is good for eternity (which it wouldn’t be). We will pretend this is for Lisa Doe, a 64 year old, healthy female.

Single Premium Whole Life

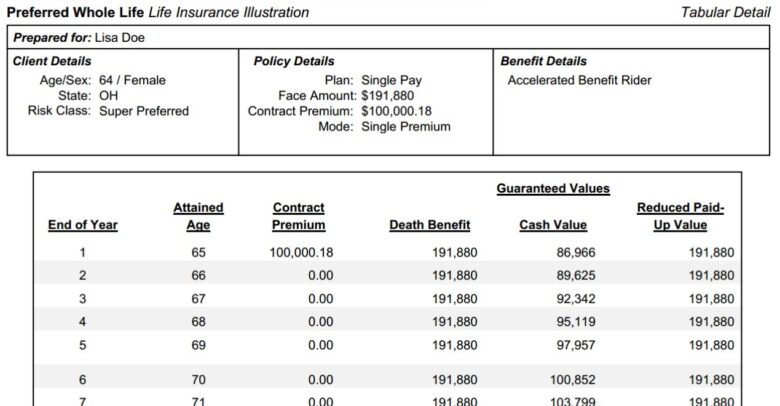

Lisa is healthy and applies for a single premium whole life policy. Her and her agent applied for coverage based on a one time single premium of $100,000. Lisa is approved and in this example her death benefit is immediately $191,880. Now regardless of whether Lisa passes away soon after at age 64, or many years down the road – Lisa’s designated beneficiaries would collect the $191,880 death benefit tax free.

Certificate of Deposit

Let’s say Lisa instead finds a CD that never expires and pays an interest rate of 4.0%. Lisa deposits the entire $100,000 into the CD. With compounding interest, Jane’s balance would not catch up to the day 1 whole life insurance death benefit amount of $191,880 for 17 years, or age 81. If Lisa continues to live past 81, it still works out for her.

But as we all know, how long we live isn’t guaranteed – but we can guarantee the amount we leave our heirs in the form of a death benefit.