Your Future Can Be Bright with Life Insurance

We get it. Talking about life insurance is difficult. But, in a world of uncertainty and change, planning for the future can help bring you peace of mind.

You may not plan on needing life insurance for a long time, but it’s never too early to purchase. It’s easy to think of reasons to delay purchasing life insurance.

You may think…

- I am young.

- We have plenty of time.

- I have life insurance through my employer.

- We do not have children yet

However, all of these statements are actually great reasons to start considering life insurance today.

Age and health are two factors that affect the price of life insurance. Premiums may cost less at a younger age, and more health issues typically arise as you age. So, purchasing life insurance today could potentially provide you with lower rates for the future and keep you covered through unexpected events.

Sure, you may have life insurance through your employer, but is it enough? Most employer-based life insurance policies may cover funeral costs and immediate needs, but expenses like mortgage, debt and legacy planning are not always included. It is important to look into this plan to ensure it provides the right amount of coverage for your family.

Let’s dive into more reasons why life insurance is important and the different options that are available for purchase.

Why is life insurance important?

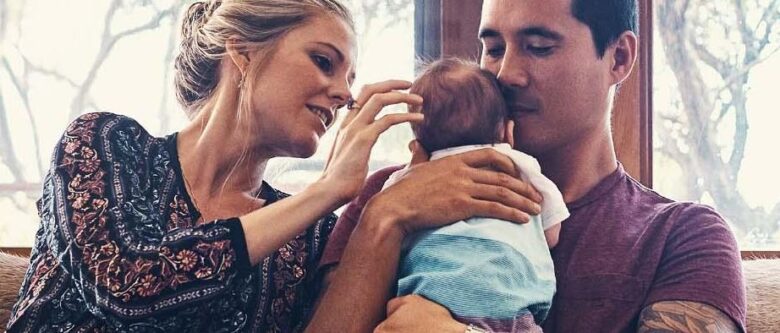

Life insurance is not about today; it’s about the future. Many of the biggest changes in people’s lives – careers, marriages, starting a family, etc. – happen in their 20s and 30s. With these life changes, you could become financially responsible for other people while also taking on debt.

Life insurance is a way to plan ahead for the unexpected. No one likes talking about death, but it’s a reality we all face. In the event of your passing, life insurance will help your loved ones pay for expenses, such as a mortgage, after the loss of your income.

So, what are your options?

Many people will start with term life insurance, as the premiums are typically lower and it is often convertible to a permanent product with little or no additional underwriting. This term insurance could cover the expenses previously discussed, while being budget-friendly as careers and families begin.

Another great option is universal life insurance because it builds cash value and offers a lot of flexibility. While it is permanent life insurance, it can be adjusted as life and budgets change.

Life insurance is a major foundation to protect you, your family and your future.